International Business Group, LLC Acquires IBG Business Platform

International Business Group, LLC announces it has acquired the operating platform of IBG Business Services, Inc., a Denver based M&A advisory firm...

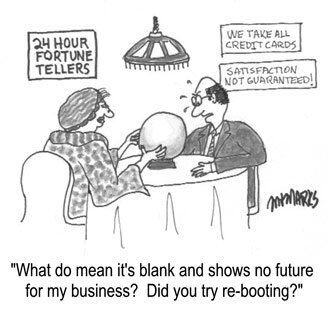

Making a good selling decision requires good information. Knowing how much your business is worth, in the mergers and acquisitions (M&A) and business sales context, is far too important to rely on informal advice (even from well-meaning sources), rules of thumb, or dissimilar comparisons.

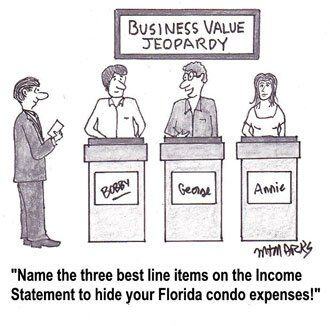

If a business owner doesn't have a background in accounting principles, he or she should consider taking basic courses at a local community or technical college. It can make a real difference in creating profits and maximizing the value of their company!

If a business owner doesn't have a background in accounting principles, he or she should consider taking basic courses at a local community or technical college. It can make a real difference in creating profits and maximizing the value of their company!

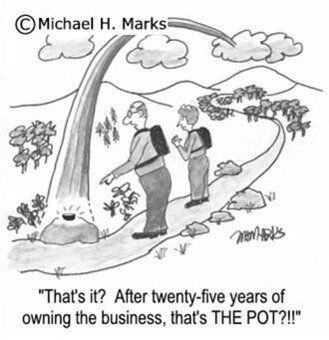

So Where Is That Pot of Gold at the End of the Rainbow?

So Where Is That Pot of Gold at the End of the Rainbow?

What About That Big Customer?

What About That Big Customer? Timing Is Everything!

Timing Is Everything!

Keeping Up with Technology

Keeping Up with Technology

International Business Group, LLC announces it has acquired the operating platform of IBG Business Services, Inc., a Denver based M&A advisory firm...

Deciding to sell your business is a monumental step that requires careful consideration of various factors, including three critical aspects to...